Spousal Social Security Benefits: Three Things All Retired Couples Should Know

For decades, Social Security has been one of the most important social programs in the United States. Especially in retirement, it provides vital income to millions of Americans across the country. After years of paying Social Security taxes, beneficiaries receive a variety of rewards through the financial safety net.

However, these benefits are not limited to those who have worked and paid taxes over the years. For example, Social Security allows spousal benefits to support a spouse who is not working or has a low income in retirement.For any couple approaching retirement or making financial plans, here are three things they should know social security spousal benefits.

1. How Social Security Spousal Benefits Work

Social Security usually calculates recipients’ monthly benefits Use formula This takes into account their 35 highest earning years. However, a spouse may receive Social Security benefits based on his or her partner’s earnings record if he or she is 62 or older or cares for a child under 16 or has a disability.

Assuming the person receiving spousal benefits has reached full retirement age, they are also eligible for 50% of their spouse’s primary coverage amount.

For example, if Spouse A’s earnings record allows them to receive $2,000 per month in benefits at full retirement age, Spouse B can also receive up to $1,000 per month. The exact amount will depend on the age at which Spouse B receives benefits.

2. The impact of receiving benefits too early or too late

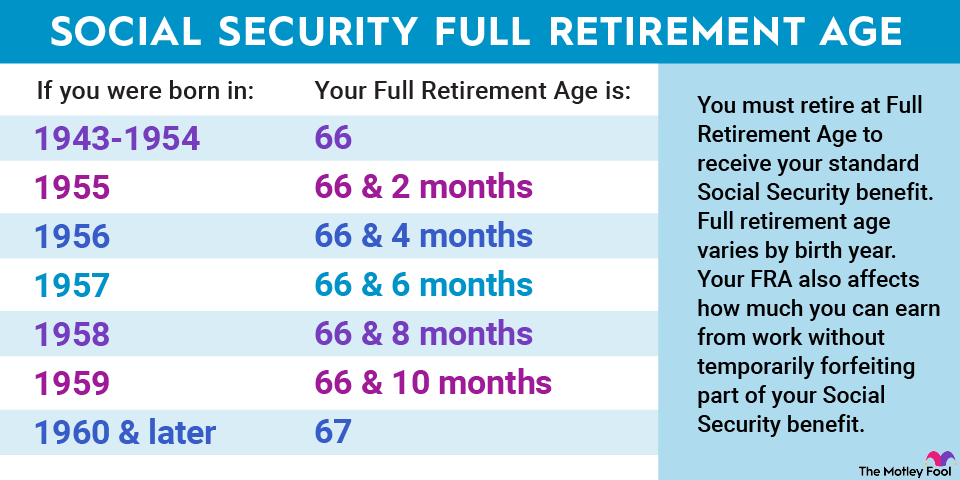

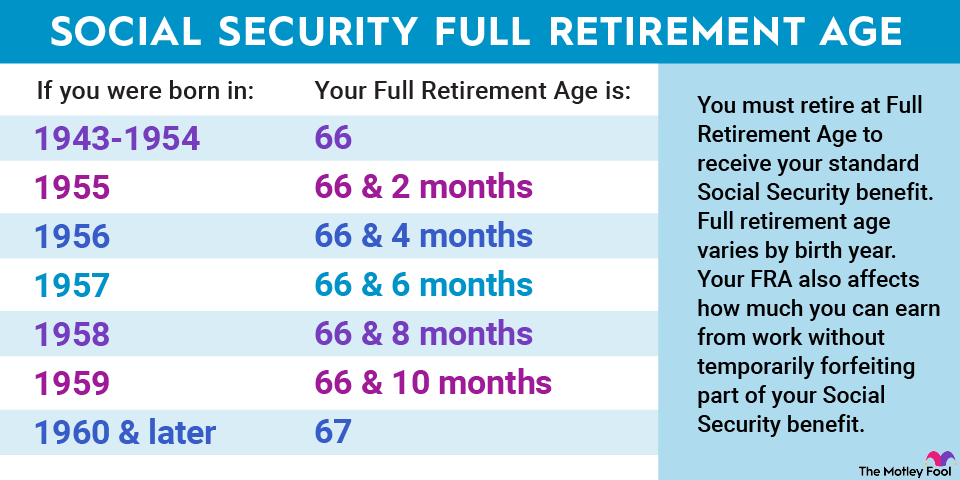

Your full retirement age is one of the most important numbers related to Social Security because it tells when you will qualify for your primary coverage amount. However, you don’t have to take benefits at full retirement age; you can file early (which reduces your payments) or late (which increases your payments).

Taking Social Security benefits early affects spouses and their partners who receive spousal benefits in different ways.

Looking first at people claiming based on their employment record, their benefits are reduced by 5/9 of 1% per month until they reach full retirement age, for up to 36 months. Thereafter, the benefit is further reduced by 5/12 of 1% per month. Here is an example: someone whose retirement age is 67, but takes a claim at age 62, their monthly benefit will be reduced by 30% from the primary sum insured.

For those receiving spousal benefits, the benefit decreases by 1% of 25/36ths each month for up to 36 months until full retirement age is reached, and then decreases by 1% of 5/12ths of each month thereafter. The same full-age retiree (age 67) who takes spousal benefits at age 62 will see their check reduced by 35%.

Although benefits generally increase if you wait until past full retirement age, these delayed retirement credits do not apply to spousal benefits.

3. What to do if your spouse dies?

Social Security spousal benefits and survivor benefits can be closely related, as the latter provides important financial assistance after a partner passes away.

If you receive spousal benefits when your partner dies, Social Security converts your spousal benefits to survivor benefits. Survivor benefits entitle you to receive up to 100% of your deceased spouse’s benefits, including any delayed retirement points they previously earned. A widow or widower can begin receiving survivor benefits at age 60 (or age 50 if disabled), but Like spousal benefits, survivor benefits will be reduced if taken before full retirement age.

You cannot receive both a spousal benefit and a survivor benefit at the same time, only whichever is higher. Because spousal benefits can be up to 50% of the partner’s primary policy amount, survivor benefits are generally the higher-paying option.

The $21,756 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But some little-known “Social Security secrets” can help ensure your retirement income grows. For example: Simple tips can help you pay up to $21,756 more per year… Once you learn how to maximize your Social Security benefits, we think you’ll be ready to retire with the peace of mind we all strive for . Just click here to learn how to learn more about these strategies.

Motley fool has a disclosure policy.

Spousal Social Security Benefits: Three Things All Retired Couples Should Know Originally published by The Motley Fool